Navigating the health insurance landscape can be challenging for small business owners in Texas.

Offering health insurance not only helps attract and retain top talent but also ensures the well-being of employees, leading to a more productive workforce.

In Texas, there are specific regulations, options, and providers available that make the decision-making process slightly different from other states.

This article provides a detailed overview of small business health insurance plans in Texas, breaking down your options, legal requirements, potential benefits, and tips on how to choose the right plan.

Why Health Insurance Matters for Small Businesses

Employee Retention and Recruitment

Small businesses often compete with larger corporations that offer robust benefits packages.

Offering health insurance helps level the playing field, showing potential hires that your business is invested in their health and future.

Research consistently shows that health benefits are a top factor employees consider when choosing an employer.

Moreover, health insurance can significantly reduce turnover. Employees are more likely to stay with an employer that provides essential benefits like health coverage, making them feel secure and valued.

Legal Compliance

In Texas, businesses with 50 or more full-time equivalent (FTE) employees are required by the Affordable Care Act (ACA) to offer health insurance or face penalties.

While businesses with fewer than 50 employees are not mandated to provide insurance, doing so can still offer tax benefits and improve workforce morale.

Additionally, Texas has its own health insurance rules that small business owners need to be aware of,

including regulations on how health insurance can be offered and priced. We will dive into these state-specific details below.

Key Considerations Before Choosing a Plan

Business Size and Type

Before diving into the details of various plans, it’s essential to assess the size of your business.

For example, if you have fewer than 50 employees, you’re not obligated to offer health insurance,

but tax incentives through the Small Business Health Options Program (SHOP) marketplace might make it beneficial.

For businesses with 50 or more employees, compliance with ACA mandates is crucial.

Additionally, consider the demographics of your employees. Younger employees might prefer different coverage options compared to older ones, so it’s important to evaluate what works best for your team’s needs.

Budget and Costs

The cost of health insurance is a significant factor for small businesses. Employers typically share the cost of premiums with employees.

The percentage can vary, but many employers aim to cover at least 50-70% of the premium.

The types of plans you choose—such as PPOs, HMOs, or High-Deductible Health Plans (HDHPs)—can also affect the price.

It’s essential to evaluate how much your business can afford while ensuring that the plan remains attractive to your employees.

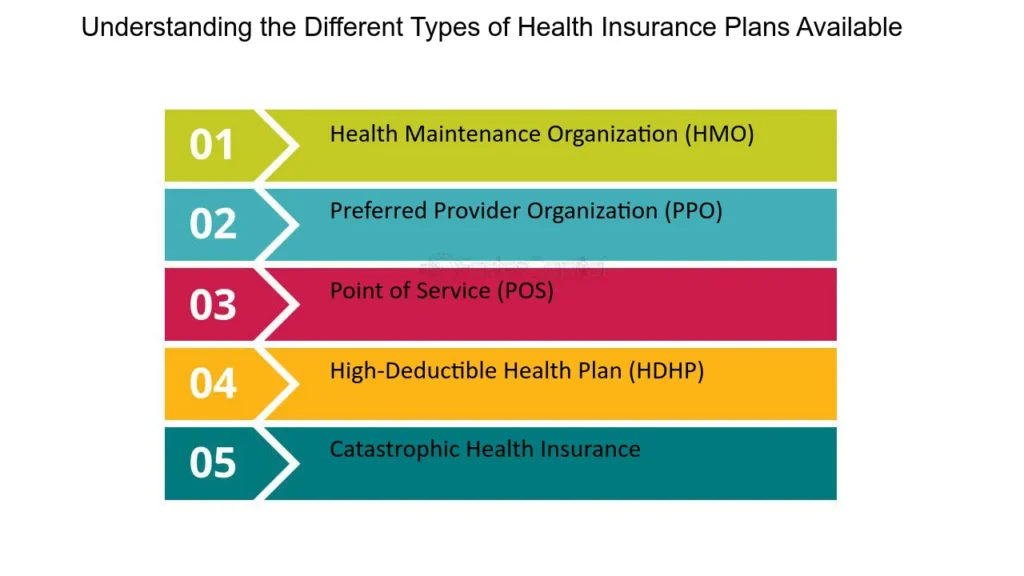

Types of Health Insurance Plans Available in Texas

Top 10 Univercities In Florida

Preferred Provider Organization (PPO)

PPOs are popular among employees due to their flexibility. They allow employees to see any doctor or specialist without a referral,

although visiting in-network providers usually results in lower costs. This flexibility comes with higher premiums, but for many employees, the convenience and breadth of care make it worth the extra cost.

Health Maintenance Organization (HMO)

HMOs generally have lower premiums and out-of-pocket costs compared to PPOs. However, employees must choose doctors within the HMO’s network and will need a referral from a primary care doctor to see a specialist.

While this limits flexibility, it offers a more affordable option for small businesses and their employees.

High-Deductible Health Plan (HDHP) with Health Savings Account (HSA)

An HDHP is paired with an HSA, which allows employees to save money tax-free for medical expenses.

These plans have lower premiums but higher deductibles. They are ideal for younger, healthier employees who don’t anticipate needing regular medical care.

Exclusive Provider Organization (EPO)

EPOs offer a middle ground between PPOs and HMOs. Like HMOs, they require employees to use a network of doctors, but they don’t need referrals to see specialists. However, out-of-network care is not covered, except in emergencies.

Tax Benefits for Small Businesses Offering Health Insurance

Small Business Health Care Tax Credit

If your business has fewer than 25 full-time employees and you offer a health plan through the SHOP marketplace, you may qualify for the Small Business Health Care Tax Credit.

The credit can cover up to 50% of the premium costs for your employees, making health insurance more affordable for your business.

Pre-Tax Contributions

Offering health insurance also allows employees to contribute to their premiums with pre-tax dollars.

This reduces the overall taxable income for employees, providing them with an additional financial incentive.

Legal Requirements for Small Business Health Insurance in Texas

Best Credit Cards For Travel Rewards

The Affordable Care Act (ACA)

As mentioned, businesses with 50 or more employees must offer health insurance or face potential penalties under the ACA.

This rule is applicable nationwide, including Texas. The ACA also mandates that insurance must meet certain coverage standards,

including essential health benefits like emergency services, maternity care, and prescription drugs.

Texas-Specific Regulations

Texas allows insurers to adjust premiums based on factors like age, location, and tobacco use.

However, they cannot base premiums on an employee’s health status. Additionally, Texas law requires all health insurance plans to cover certain services, such as mental health care, which can affect the overall cost of the plan.

How to Choose the Right Plan for Your Business

Assess Your Employees’ Needs

The first step in selecting a plan is to understand what your employees need. Conducting an anonymous survey can help you determine their preferences for doctor networks, out-of-pocket costs, and additional services like dental or vision coverage.

Compare Costs and Benefits

Once you have a sense of what your employees want, compare different plans to see which one offers the best balance between cost and coverage.

Don’t just focus on the premium; consider deductibles, co-pays, and out-of-pocket maximums as well.

Leverage the SHOP Marketplace

The SHOP marketplace was created to help small businesses compare and purchase health insurance.

It’s an excellent resource for finding ACA-compliant plans and checking if your business qualifies for any tax credits.

Health Insurance Providers for Small Businesses in Texas

Blue Cross Blue Shield of Texas

Blue Cross Blue Shield is one of the largest health insurance providers in Texas, offering a variety of plans tailored to small businesses.

They provide excellent customer service, a vast network of providers, and customizable plan options.

UnitedHealthcare

UnitedHealthcare is another popular option for small businesses in Texas. Their plans offer robust coverage options, including wellness programs, mental health services, and online health management tools.

Aetna

Aetna offers affordable options for small businesses and is known for its high-quality network of doctors and hospitals.

Their plans often include wellness incentives, telehealth services, and disease management programs.

Humana

Humana focuses on affordable plans for small businesses, especially those with fewer than 50 employees.

They offer options with low premiums and integrated wellness programs designed to keep employees healthy and productive.

Overcoming Common Challenges in Offering Health Insurance

Balancing Costs and Coverage

One of the most common challenges for small businesses is balancing the cost of premiums with the level of coverage provided.

High premiums can strain a business’s budget, but inadequate coverage might deter top talent from joining your team.

To strike the right balance, explore different plan types, such as HDHPs, which offer lower premiums but higher deductibles.

Keeping Up with Regulatory Changes

Healthcare regulations are continually evolving, and staying informed can be a challenge.

Partnering with a licensed insurance broker or advisor can help ensure that your business stays compliant with both federal and state regulations while offering competitive health plans.

Maximizing Employee Engagement with Health Insurance

Educating Your Employees

Many employees may not fully understand the value of the health insurance plans being offered.

Regular communication, informational sessions, and easy-to-understand materials can help employees make informed decisions about their coverage.

Promoting Wellness Programs

Many health insurance plans offer wellness programs that encourage healthy behavior through incentives like discounted gym memberships or rewards for completing health assessments.

These programs can improve employee well-being and reduce the overall cost of healthcare.

Wrapping Up: Building a Healthier, More Productive Team

Offering health insurance to your small business employees in Texas is more than just a legal or financial decision—it’s an investment in your team’s well-being and productivity.

By selecting the right plan and providing comprehensive health coverage, you can create a workplace culture that values health, security, and employee satisfaction.

The benefits, from increased employee retention to potential tax incentives, make offering health insurance an important step in building a thriving business in Texas.

Frequently Asked Questions (FAQ)

1. Do I have to offer health insurance if I have fewer than 50 employees?

No, you are not required to offer health insurance if you have fewer than 50 full-time employees. However, doing so can provide benefits like tax credits and increased employee retention.

2. What is the Small Business Health Care Tax Credit?

The Small Business Health Care Tax Credit is available to businesses with fewer than 25 full-time employees that offer insurance through the SHOP marketplace. It covers up to 50% of premium costs.

3. What’s the difference between PPO and HMO plans?

PPOs offer more flexibility in choosing healthcare providers and do not require referrals to see specialists, but they come with higher premiums. HMOs are generally more affordable but limit your choice of doctors and require referrals for specialists.

4. How do I choose the best plan for my employees?

To choose the best plan, assess your employees’ needs, compare costs and coverage, and consider using resources like the SHOP marketplace to find plans that offer the best value.

5. What is an HDHP and how

An HDHP is a high-deductible health plan that typically has lower premiums but higher deductibles. It can be paired with a Health Savings Account (HSA) to allow employees to save money tax-free for medical expenses.

Pingback: Top 10 Lawyers In Texas – BestUnivercity

Pingback: Top 10 Universities in Texas – BestUnivercity

Pingback: Top 10 Lawyers In USA – BestUnivercity

Pingback: Workers Compensation Insurance Construction – BestUnivercity

Pingback: Top 10 Life Insurance Plans in California – BestUnivercity

Pingback: Photographers Professional Liability Insurance – BestUnivercity

Pingback: New Jersey Legal Malpractice Insurance – BestUnivercity

Pingback: Top 10 Life Insurance Plans in Miami – BestUnivercity