Top 10 Life Insurance Plans in California. When it comes to protecting your loved ones and ensuring their financial security, choosing the right life insurance plan is crucial.

In California, with its diverse population and varying financial needs, there is a wide range of life insurance options. Whether you’re looking for term life insurance,

whole life insurance, or universal life insurance, understanding the best options available can help you make an informed decision. Here,

we break down the top 10 life insurance plans in California, offering insights into what makes them stand out and how they can meet different needs.

1. State Farm – Term Life Insurance

Small Business Health Insurance Plans Texas

State Farm is a household name in the insurance industry and is known for its strong financial stability. Their term life insurance policies in California offer flexibility in terms of length,

typically ranging from 10 to 30 years. The key advantage of State Farm’s term life insurance is the simplicity and affordability.

With premiums remaining fixed for the duration of the term, it’s an excellent choice for Californians seeking coverage to match their financial obligations, such as paying off a mortgage or supporting a family.

Additionally, State Farm allows for policy conversion to permanent insurance without a medical exam, which is highly beneficial for those planning long-term protection.

Highlights:

- Affordable premiums

- Flexible term lengths (10, 20, 30 years)

- Option to convert to permanent insurance

2. Northwestern Mutual – Whole Life Insurance

For those seeking permanent life insurance, Northwestern Mutual’s whole life policies are among the best in California. Whole life insurance is designed to last a lifetime,

with premiums that remain constant and a cash value component that grows over time.

Northwestern Mutual’s whole life insurance stands out because of its dividends. As a mutual company, policyholders may receive dividends based on the company’s financial performance,

which can be used to reduce premiums, increase cash value, or even be taken as cash.

Highlights:

- Lifetime coverage

- Consistent premiums

- Dividend payments

3. New York Life – Universal Life Insurance

New York Life offers one of the most flexible universal life insurance policies in California. Universal life insurance provides lifetime coverage with the added benefit of adjustable premiums and death benefits.

This flexibility makes it ideal for people whose financial circumstances might change over time.

New York Life’s universal life insurance is popular for its ability to accumulate cash value. Policyholders can use the cash value for a variety of purposes,

including supplementing retirement income or covering emergency expenses.

Highlights:

- Lifetime coverage with flexible premiums

- Cash value accumulation

- Customizable death benefit

4. Guardian Life – Indexed Universal Life Insurance

Guardian Life’s indexed universal life (IUL) insurance is a great choice for Californians who want the flexibility of universal life insurance but with the potential for higher returns.

An IUL policy allows policyholders to allocate the cash value to various market indexes, such as the S&P 500, offering potential growth based on market performance.

While the returns are not guaranteed, Guardian Life’s IUL policies come with a floor, meaning policyholders won’t lose money if the market underperforms.

This makes it a balanced option for those interested in growth potential with some protection against losses.

Highlights:

- Indexed growth potential

- Flexibility in premium payments and death benefits

- Cash value with downside protection

5. Pacific Life – Variable Universal Life Insurance

Pacific Life’s variable universal life (VUL) insurance is designed for those looking to combine life insurance with investment opportunities. With a VUL policy,

the cash value can be invested in a variety of separate accounts, similar to mutual funds.

While this offers the potential for higher returns, it also comes with increased risk. However, Pacific Life’s VUL policies are particularly well-regarded for their broad selection of investment options and solid performance.

It’s an excellent choice for Californians comfortable with taking on more financial risk for the possibility of greater rewards.

Highlights:

- Investment options within the policy

- Flexible premiums and death benefits

- High growth potential

6. Transamerica – Term Life Insurance

Transamerica offers competitive term life insurance options that are particularly appealing for younger families and individuals in California.

The simplicity of Transamerica’s term life policies, combined with their affordability, makes them an excellent choice for those who need temporary coverage.

What sets Transamerica apart is their commitment to offering high coverage amounts at affordable rates. Additionally,

their policies include options for converting to permanent insurance, giving policyholders long-term flexibility.

Highlights:

- Affordable rates for young policyholders

- High coverage amounts

- Conversion options to permanent policies

7. MassMutual – Whole Life Insurance

MassMutual is another mutual company that offers whole life insurance with the added benefit of dividends. Their policies are known for being reliable and providing consistent growth of cash value over time.

MassMutual’s whole life insurance policies are popular among Californians who are looking for long-term financial security and the peace of mind that comes with guaranteed death benefits.

The dividends earned can be reinvested into the policy, further enhancing its value.

Highlights:

- Guaranteed lifetime coverage

- Dividend opportunities

- Strong cash value accumulation

8. AIG – Guaranteed Issue Whole Life Insurance

AIG’s guaranteed issue whole life insurance is designed for those who might have difficulty qualifying for traditional life insurance due to age or health concerns. With guaranteed acceptance,

there are no medical exams required, making it accessible to a broad range of Californians.

While the coverage amounts are typically lower, AIG’s policies provide peace of mind knowing that your loved ones will receive financial support.

It’s an excellent option for older individuals or those with pre-existing conditions.

Highlights:

- No medical exams required

- Guaranteed acceptance

- Affordable premiums for low coverage amounts

9. Prudential – Term Life Insurance

Top 10 Insurance Plans in the USA

Prudential offers a wide range of term life insurance options that are ideal for Californians looking for coverage that aligns with their specific financial obligations.

With flexible term lengths and the ability to customize your policy with riders, Prudential provides a high level of personalization.

One notable feature of Prudential’s term life insurance is their living benefits rider, which allows policyholders to access a portion of the death benefit if they are diagnosed with a terminal illness. This adds a layer of security in unexpected situations.

Highlights:

- Customizable policies with riders

- Living benefits rider for terminal illness

- Flexible term lengths

10. Mutual of Omaha – Simplified Issue Term Life Insurance

For those seeking a simplified application process, Mutual of Omaha’s simplified issue term life insurance is a top choice.

This policy allows applicants to bypass the medical exam, relying on a health questionnaire instead. It’s ideal for those who want quick and easy access to coverage.

While coverage amounts are generally lower than traditional term life policies, the ease of application and fast approval process make Mutual of Omaha’s offering an attractive option for many Californians.

Highlights:

- No medical exams required

- Fast approval process

- Simplified application

Key Considerations When Choosing Life Insurance in California

When choosing the best life insurance plan in California, it’s essential to consider several key factors:

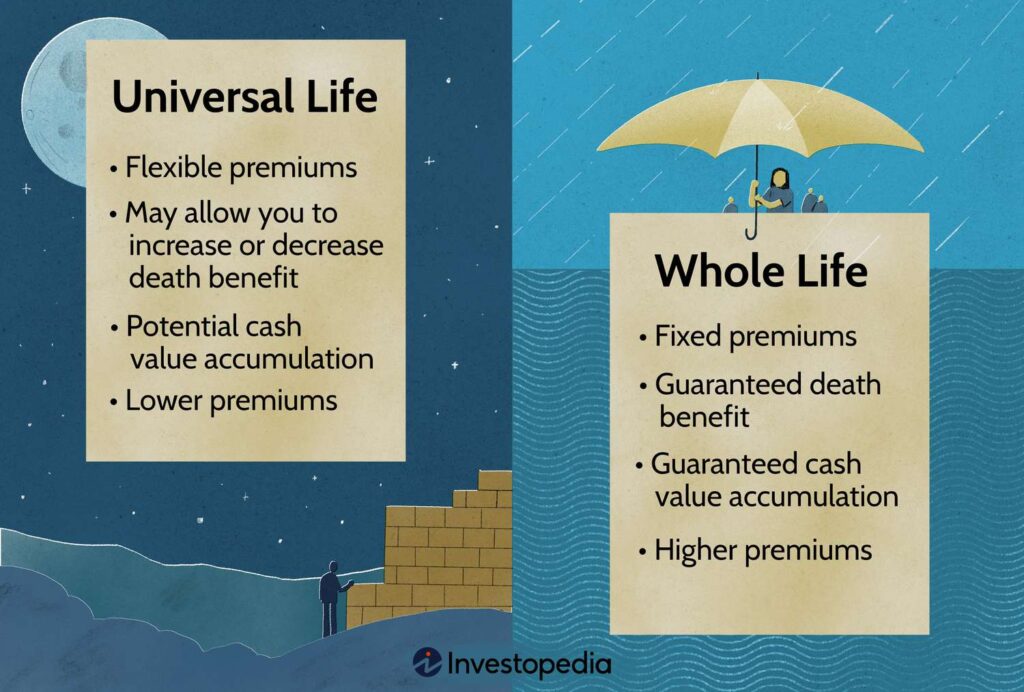

- Coverage Type: Determine whether term life, whole life, or universal life insurance is right for you based on your financial goals and how long you want the coverage.

- Premiums: Look at how much you’ll pay monthly or annually and whether the premiums are fixed or adjustable.

- Riders and Customization: Many life insurance policies allow you to add riders, such as critical illness or accidental death coverage, to tailor the policy to your needs.

- Company Financial Strength: Choose an insurer with a strong financial reputation to ensure they can pay out claims when needed.

Finding the Best Plan for You

The best life insurance plan for you depends on your individual needs, your family’s future financial security, and your risk tolerance.

Whether you need affordable term life insurance for temporary coverage or want a policy that grows cash value over time, California’s life insurance market offers something for everyone.

FAQs

1. What is the difference between term and whole life insurance?

Term life insurance provides coverage for a set period (usually 10-30 years), while whole life insurance offers lifelong coverage with a cash value component.

2. How does a universal life insurance policy work?

Universal life insurance combines lifetime coverage with flexible premiums and a cash value that grows over time, allowing policyholders to adjust the policy as needed.

3. What are dividends in life insurance?

Dividends are a portion of the insurer’s profits returned to policyholders in some whole life policies, which can be used to reduce premiums, increase cash value, or be taken as cash.

4. Do I need a medical exam to get life insurance?

Some policies, such as simplified issue or guaranteed issue policies, do not require medical exams, while traditional policies typically do.

5. How do I know which life insurance policy is right for me?

Assess your financial needs, long-term goals, and risk tolerance. Working with a financial advisor can also help you find the best policy.

Securing Your Future in California

Choosing the right life insurance plan is a critical step in securing your financial future and ensuring your loved ones are taken care of. With so many excellent options available in California,

finding the policy that meets your needs is within reach. By comparing the top 10 life insurance plans and understanding the key factors, you can confidently make a decision that aligns with your goals.

Pingback: Top 10 Life Insurance Plans in Texas – BestUnivercity